Automate invoice-to-payment workflows with policy enforcement, GL coding, and full audit traceability

CFOs appreciate RedOwl’s AP Agent because it transforms accounts payable from a reactive task into a controlled, predictable process. With real-time policy enforcement, clean GL entries, and automated audit trails, it reduces risk while improving speed and accuracy. It gives finance leaders confidence that spend is compliant, approvals are consistent, and close cycles stay on track — without adding headcount.

Finance Controllers rely on RedOwl’s AP Agent to enforce policy at the transaction level without constant oversight. Automated checks, clean journal entries, and clear approval chains tighten controls and keep your books accurate in real time — freeing up your team to focus on higher-value tasks.

Finance Ops teams use the AP Agent to cut out repetitive tasks and manual data entry. With automated invoice matching, hands-free routing, and real-time spend visibility, your team can process more invoices faster — with fewer errors and escalations.

Internal Auditors trust RedOwl’s AP Agent to maintain airtight audit trails automatically. Every invoice, approval, and policy check is logged in real time, making it easy to pull evidence, prove compliance, and close audits faster with less back-and-forth.

The AP Agent handles accounts payable from end to end — automatically ingesting invoices, validating them against purchase orders or contracts, assigning GL codes, and routing them through approval workflows based on your internal policies. Once approved, it initiates payment via your connected bank accounts and completes reconciliation without manual intervention.

RedOwl’s AP Agent doesn’t just complete tasks — it adheres to structured financial processes. It ensures every payable follows your defined path from initiation to reconciliation, with built-in logic for sequencing, validation, and escalation.

The agent enables finance teams to maintain visibility and control without micromanaging every transaction. Reviewers are looped in only when necessary, while routine steps are handled autonomously — with full transparency.

Rather than treating audit as an afterthought, the AP Agent builds traceability into every action. It maintains evidentiary records that support both external audits and internal process reviews — without additional prep.

The AP Agent plugs into your general ledger, bank, and procurement tools — no ERP overhaul required. It syncs data across systems while keeping your source of truth intact and up to date.

Whether you’re processing 50 invoices or 5,000, the AP Agent applies rules uniformly. This reduces discrepancies, speeds up approval cycles, and ensures process reliability as your business grows.

Ingests invoices via email, upload, or integration and uses AI to extract key fields — eliminating manual data entry.

Cross-references invoices with existing purchase orders and vendor contracts to ensure accuracy and prevent mismatches.

Automatically routes invoices for approval based on amount thresholds, departments, or vendor-specific logic you define.

Applies your internal spend policies up front — blocking or flagging items that exceed limits, lack documentation, or fall outside standard terms.

Assigns the correct chart of accounts, tax codes, and dimensions, then generates journal entries ready for sync with your general ledger.

Schedules approved payments through your connected bank accounts or payment platforms, with full tracking and confirmation.

Captures a detailed log of every action, decision, and data change across the workflow — all timestamped and easily exportable.

Automatically identifies repeated invoice numbers, round-dollar amounts, or unusual patterns that signal potential issues.

Reduces back-and-forth between teams and eliminates manual reconciliation tasks, helping you close the books faster with fewer errors.

RedOwl’s AI agents link every part of your finance stack, from ERP to banks. They sync data, enforce policies, and automate workflows — all with a clear audit trail you can trust.

Learn More >>

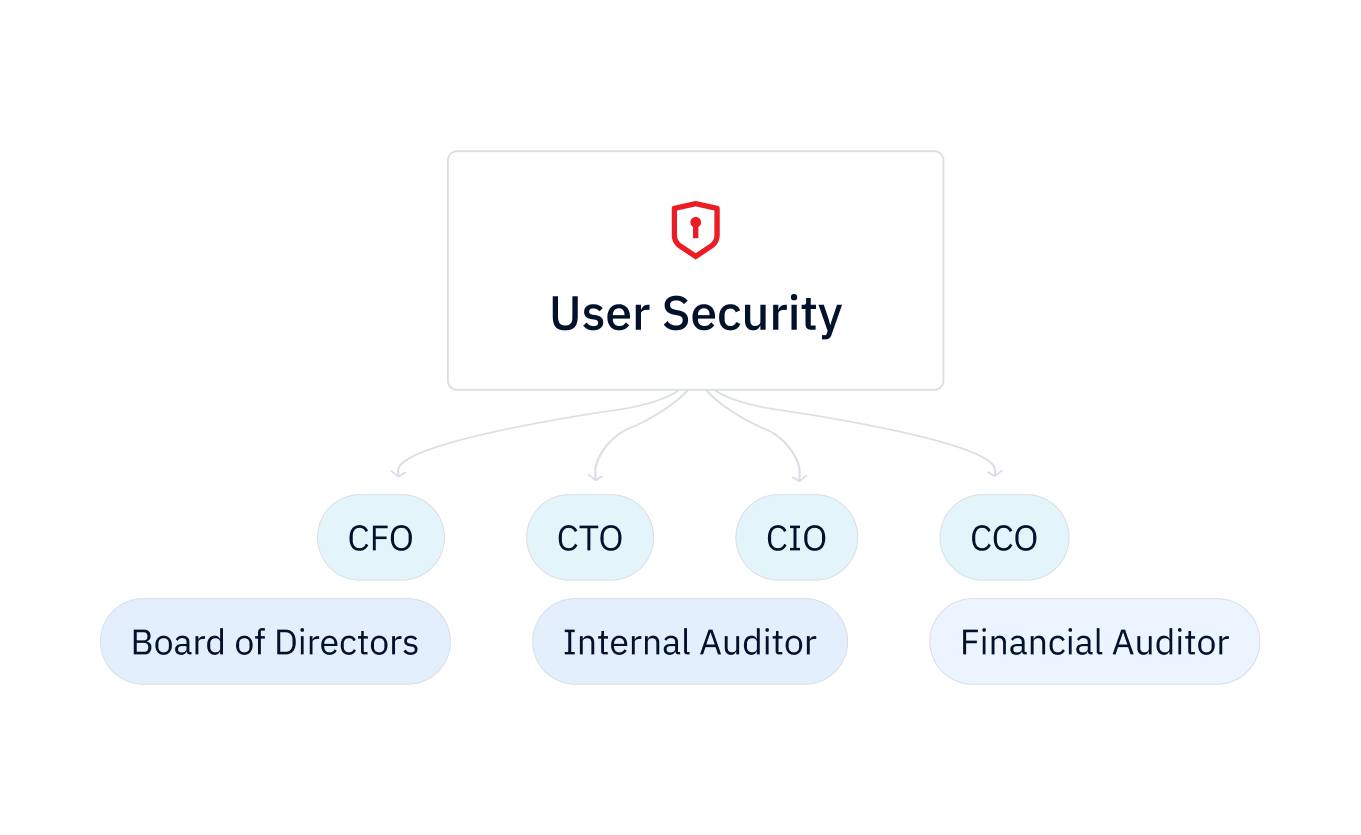

RedOwl’s AI agents protect your workflows with strict controls and end-to-end encryption. Every action is logged, policies are enforced, and your data stays compliant and safe.

Learn More >>

The AP Agent uses AI to read, match, and validate invoices without manual data entry. It auto-routes them for approval and payment once checks pass.

Yes — you can set up custom approval rules based on department, spend limits, or vendor type. This ensures the right people sign off before money goes out.

If an invoice doesn’t pass checks, it’s flagged instantly for review. You’ll get clear details on what’s wrong so you can fix or reject it.

Yes — the AP Agent connects directly with your ERP, accounting software, and bank feeds. This keeps your books and payments in sync automatically

In a live demo, we’ll show you how RedOwl agents automate real workflows like invoice approvals, policy enforcement, and audit logging — all while integrating seamlessly with your existing systems.

Book your demo